Bestseller

BankBridge

Your Pathway to Banking Success

Batch Starting On 1st June 2025

- Live instructor-led 6 months course

- Learn Core Banking, Financial Analysis, Risk Management, and Digital Banking

- Gain hands-on experience with real-world projects using industry-aligned tools

- Dedicated job referrals for banking and financial sector roles

Join the only Certified #1 Ranked Banking Course in India, Led by Industry Experts from Top Banks and Transform Your Career Today!

40% Average Hike

in Job Switch

6 Months

Weekend Classes

Practical Learning

Real Time

Job Assistance

100% Placements

Starts at INR 6,000/month*

EMI Options Available

An Introduction to BankSkool

Get Assured Interview Call from Top Recruiters

Over 50+ Hiring Partners

Certificate Course in Banking Mastery Overview

Join our live instructor-led Banking Course and become a proficient banking professional in just 6 months! Gain expertise in essential banking areas such as Core Banking, Financial Analysis, Risk Management, Digital Banking, and more. Our industry-aligned banking syllabus will guide you through 10+ real-world banking projects, ensuring hands-on experience. Enhance your career readiness with mock interviews and benefit from dedicated job referrals. Elevate your banking career with our exclusive Career Service.

Key Features

About The Course

A BankSkool course provides foundational knowledge and skills required for various roles in the banking and financial services industry. It covers essential topics such as banking operations, financial analysis, risk management, credit assessment, and compliance. Students learn about banking regulations, financial products, and customer service, equipping them to handle a wide range of responsibilities, from branch management to loan assessment. The course may also offer specialized modules in investment banking, wealth management, or financial planning, depending on the focus. Completing a BankSkool course prepares individuals for a career in banking by developing their analytical, communication, and problem-solving skills, while also helping them understand the intricacies of the financial system.

What will you learn ?

This course is designed to provide you with an in-depth understanding of the banking industry's core operations and practices. You will learn how to manage accounts, process loans, and handle day-to-day branch activities efficiently. The course covers essential topics like compliance, risk management, and digital banking, ensuring you're equipped to meet industry standards. You'll gain hands-on experience with financial products, modern payment systems, and customer relationship strategies to enhance your professional capabilities. Additionally, you'll develop critical skills in sales, communication, and leadership to thrive in any banking role. By the end of the course, you'll be prepared to tackle real-world challenges and excel in your banking career.

Our Goals

Provide Comprehensive Education

Deliver in-depth and up-to-date training programs covering all essential aspects of banking, including financial products, banking operations, and regulatory compliance.

Foster Skill Development

Enhance students' practical skills through hands-on workshops, real-world case studies, and interactive learning experiences.

Promote Professional Growth

Offer personalized coaching and mentorship to help students develop their career paths and achieve their professional aspirations in the banking industry.

Cultivate a Learning Community

Create a supportive and collaborative learning environment where students can share knowledge, network, and grow together.

Stay Industry-Relevant

Continuously update our curriculum and training methods to reflect the latest trends and technologies in the banking sector.

Achieve High Success Rates

Strive for a high placement rate of our graduates in reputable banking institutions, ensuring they are well-prepared for their roles.

What’s a great curriculum without practical-based learning?

Projects will be a part of your Certification in Banking Course to consolidate your learning. It will ensure that you have real-world experience in Banking Field.

Practice 10+

Interview Sessions

Practice 20+

Sales Pitch Skills

Practice 10+

Job Challenges

BankBridge Course Syllabus

Bankskool provides Live, Interactive Online Sessions guided by Professionals working in top MNCs. All sessions are covered practically with real-time industrial projects and case studies.

- Overview of banking system

- Type of Banks (PSU, Private, NBFC, RRB, Co-Operative, SFB, Payment Banks, etc.)

- Regulatory Environment and key regulations (RBI, SEBI, IRDAI)

- Importance of Banks in the economy

- Domestic & International Banking System

- Different Departments within a bank

- Type of Banking Products (SA, CA, Demat Account, NRI Account, FD, RD, Loans, Credit Card, Debit Card, Prepaid Card, Insurance, Mutual Fund)

- Overview of Financial Services offered by Banks

- Introduction to Digital Banking and Fintech Innovations

- TRADE Forex

- Transactions (Deposits, Withdrawals, RTGS, NEFT, IMPS, UPI, ebanking)

- KYC and Account Opening Process

- Security Measures in banking transactions

- Cash Operations

- Cheque Clearing & Cheque Truncation System

- Audit & Risk

- Compliance Tools

- Frauds and Prevention Technique

- Grievance Cell

- Banking Ombudsman

- RBI

- Overview

- Different types of Banking Solutions used in Banks

- Ethical Issues in Banking

- Principles of good corporate governance

- Case Studies on Ethics in Banking

- Key financial ratios used in banking

- Interpreting financial health of banks

- Basics of credit analysis and lending principles

- Various Roles in a Bank (Teller, Customer Relationship Manager, Customer Service Manager, Loan Officer etc.)

- Career Progression and Advancement Opportunities in Banking Sector

- Skills and Qualifications needed for different banking positions

- Importance of Professional Skills

- Product Knowledge

- Communication Skill (Important of Communication, Verbal and Written Communication Skill, Cultural Communication, Uses of Technology in Communication)

- Time Management Skill

- Leadership Skill

- Problem Solving Skill

- Sales & Marketing Skill

- Listening Skill

- Importance of Body Language

- Stress Management

- Interview preparation Tips & Techniques

Which skills will I become an expert in after this Course?

After completing this course, you will become proficient in essential banking and financial concepts. You'll gain expertise in areas such as core banking operations, financial analysis, risk management, and digital banking. This program equips you with practical skills through real-world projects and mock interviews, ensuring you're job-ready and confident to excel in the banking industry.

Banking operations mastery

Financial product expertise

Customer relationship management (CRM)

Digital banking proficiency

Sales and marketing skills

Trade finance and forex basics

Compliance and risk management

Analytical and problem-solving skills

Leadership and team management

Effective communication skills

Time management and organizational abilities

Practical knowledge of modern banking technologies

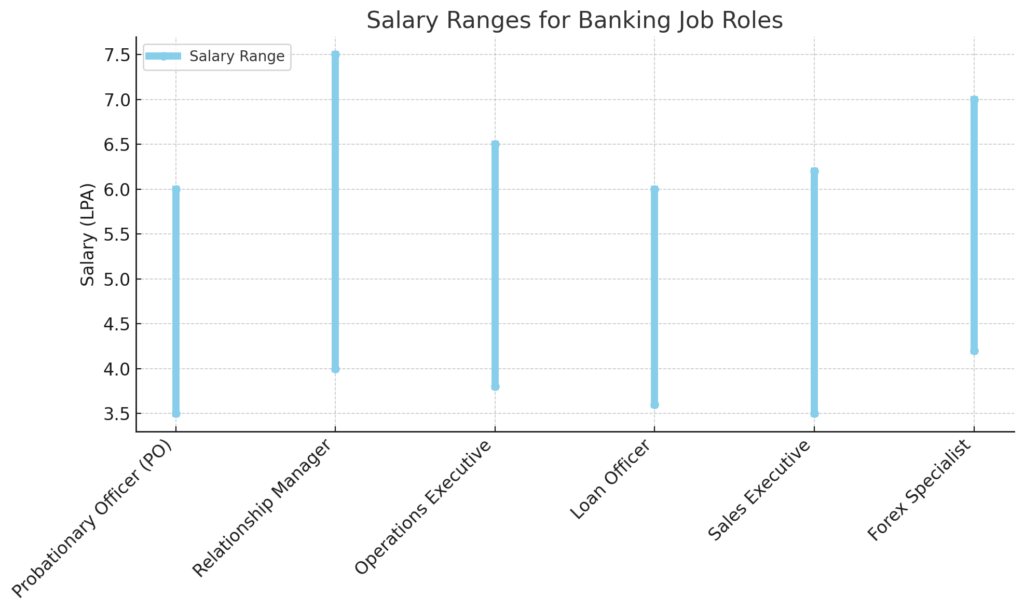

What are the Job Roles and Salary Expectations in Banking Sector?

Completing this course opens doors to various roles in the banking sector, such as Probationary Officer (PO), Relationship Manager, Operations Executive, Loan Officer, Sales Executive, and Forex Specialist. Entry-level salaries in these roles range between ₹3.5 to ₹6 LPA, depending on the role and bank. With experience, professionals can grow to mid-level positions offering salaries between ₹6 to ₹12 LPA or higher. Leadership roles in banking can command packages above ₹15 LPA, based on expertise and performance.

Why Bankskool is your gateway to a successful Banking Course?

Industry-Relevant Curriculum

Holistic Skill Development

Expert Mentorship

Certification and Networking

Practical-Based Learning

Placement Assistance

Our Mission

To empower fresh graduates and undergraduates with the knowledge, skills, and confidence needed to excel in the banking industry through comprehensive training and personalized coaching.

Our vision

To be the leading training and coaching centre that transforms aspiring bankers into industry-ready professionals, contributing to the growth and innovation of the banking sector.

Where do Bankskool Alumni Work After Course Completion?

BankSkool Certification

BankSkool Certification Advantage

Industry Recognition

The BankSkool certification is designed to meet industry standards, making you a preferred candidate for banking roles. It demonstrates your expertise in core banking operations and digital tools, giving you a competitive edge in the job market.

Enhanced Employability

With the certification, you gain credibility and validation of your skills, increasing your chances of securing roles like Probationary Officer, Relationship Manager, or Operations Executive in top banking organizations.

Career Growth Opportunities

This certification not only helps you land your first banking job but also sets the foundation for long-term growth. It positions you for promotions and leadership roles as you advance in your career.

BankBridge Course Fee ?

Total Fee

₹ 39,999

No Cost EMI

As low as ₹ 5,899/month

We have partnered with the following financing companies to provide competitive finance options at 0% interest rate with no hidden costs...

What Is the Eligibility Criteria for the BankBridge Course?

A high school diploma (12th grade) or equivalent is required, with some advanced courses needing a graduation degree.

The minimum age is typically 18 years, with age limits varying by course.

A strong interest in pursuing a career in banking is essential.

Basic computer proficiency and understanding of financial concepts may be required for some courses.

Some courses may require an entrance test or interview.

Who can apply for the BankBridge course?

- Graduates in any Stream

- Final Year Students

- Commerce and Finance Students

- Working Professionals

- Entrepreneurs and Business Owners

- Individuals Preparing for Banking Exams

What Does Bankskool BankBridge Certification Program Offer?

Comprehensive Banking Knowledge

Learn key concepts in banking operations, financial product management, and compliance, ensuring you have a strong foundation for any role in the banking sector.

Hands-On Practical Training

Gain real-world experience with tools like POS machines, digital banking platforms, and live case studies to bridge the gap between theory and practice.

Soft Skills Development

Enhance your communication, customer handling, and leadership abilities, making you a well-rounded professional ready for challenges in the banking industry.

Certification and Career Support

Earn an industry-recognized certification that validates your expertise and receive placement assistance to secure your dream banking job.

What roles will you get after completing a Bankbridge course?

After completing the course, you'll unlock opportunities for diverse roles in the banking and finance sector, such as Bank Teller, Relationship Manager, Credit Analyst, Loan Officer, and Financial Analyst. Advanced career paths include Branch Manager, Risk Manager, Compliance Officer, Investment Banker, Wealth Manager, Treasury Manager, and Insurance Advisor, equipping you to excel in leadership and specialized positions.

Bankskool Recognition & Affiliation